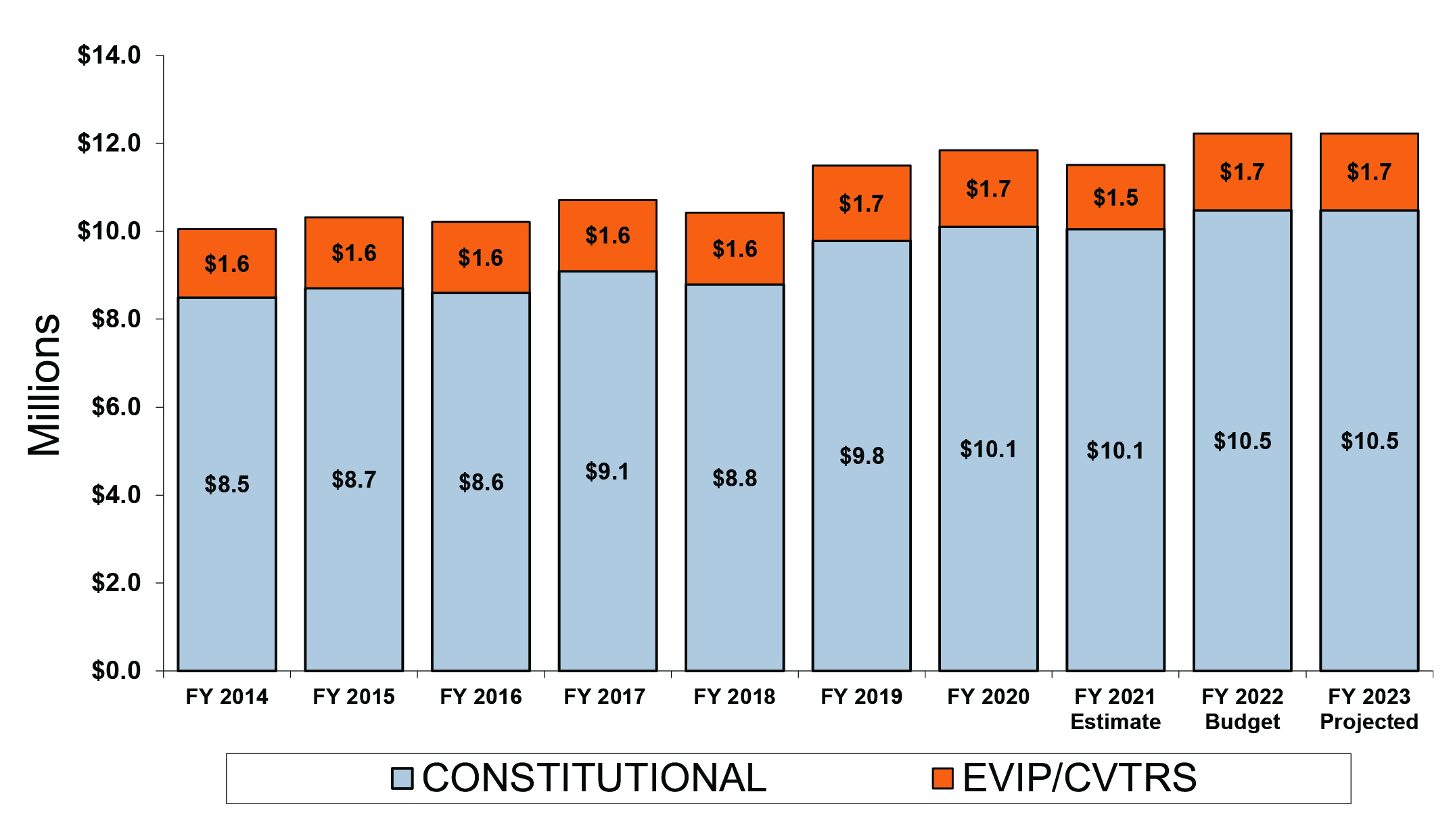

A major source of revenue for the City's General Fund is state-shared revenue. State-shared revenue distributes sales tax collected by the State of Michigan to local governments as unrestricted revenues. The distribution of funds is authorized by the State Revenue Sharing Act, Public Act 140 of 1971, as amended. Funding State-Shared revenue consists of two parts:

- Constitutional - 15 percent of the 4 percent gross collections of the state sales tax and distributed based on the population of the municipality;

- Statutory - 21.3 percent of the 4 percent gross collections of the state sales tax and distributed based on four factors. This form of revenue sharing ended in Fiscal Year 2011;

- CVTRS (City, Village, and Township Revenue Sharing Program)- The State of Michigan program states:

- Each city, village, or township that received a FY 2021 CVTRS payment is eligible to receive a payment equal to 102% of the local unit's total eligible FY 2021 payment amount.

- The City will receive 100% of the maximum amount for fulfilling all of the specific requirements for Accountability and Transparency.

- The City must submit the certification form and required documents for the category to qualify for payment.

Visit the Department of Treasury website for more information about State-shared revenue calculations.

The chart below shows the city's historical experience with state-shared revenue.