What is Fund Balance?

Fund balance is an accumulation of revenues minus expenditures. Each fund maintained by the city has a fund balance. Fund balance can be used in future years for purposes determined by City Council. To understand fund balance, it is important to understand fund accounting. Fund accounting is unique to the public sector (i.e. governments, schools, etc.) and requires separate self-balancing accounting entries to track each fund’s revenues and expenditures. Funds are created for various reasons and separated into fund types which dictate the accounting rules that apply (i.e. basis of accounting can be full accrual or modified accrual).

Funds are typically restricted in use by Michigan law, the City Charter and local ordinances to assure the funds are used for their intended purposes. The source of funding generally determines the restriction applicable to funds and thus what fund type it is. The city has more than 70 such distinct funds.

Expenditures for each fund are authorized through the budget process, which requires approval of the service area administrators, the city administrator, and, ultimately, City Council. The managers of the service units operating within the funds typically oversee approval of expenditures throughout the fiscal year. Expenses are audited annually to ensure compliance with policies.

Any surplus revenues in excess of expenditures at the end of a fiscal year fall to a fund balance within that particular fund. Each day, these funds are invested in the city’s pool of invested funds and earn interest in proportion to their participation in the pool. Fund balance from any fund can be re-appropriated for future use through the budget process, but the ongoing restrictions on that particular fund continues to apply to re-appropriated funds.

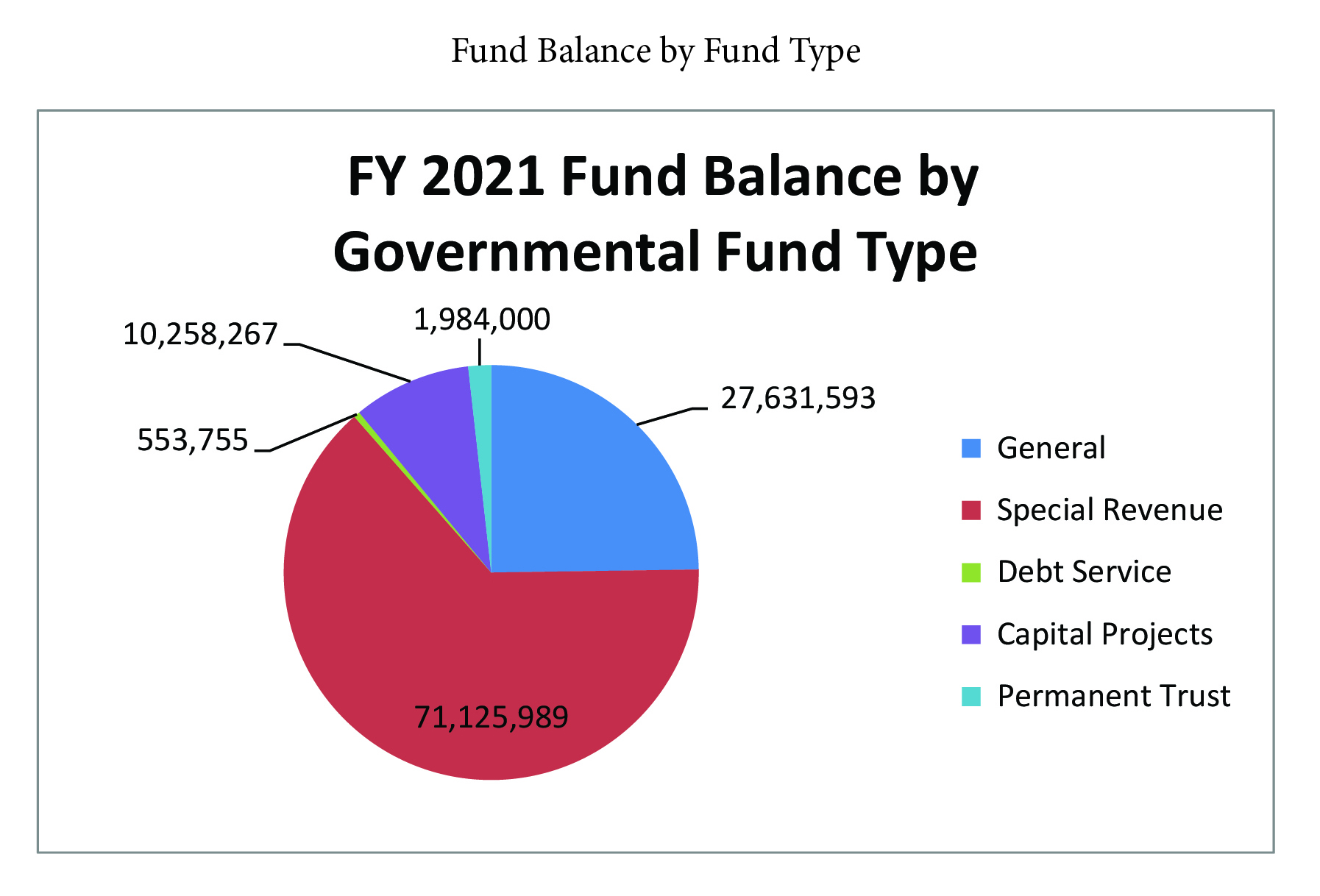

The below chart reflects how the City's fund balances reserves are restricted for use. Please see the restrictions on use of fund balance below.

General Fund – The chief operating fund of a state or local government. All of a government’s financial activities should be accounted for in the general fund unless there is a compelling reason to report an activity in some other fund type.

Special Revenue Funds – This fund type may be used to account for the proceeds of specific revenue sources (other than those from expendable trusts or for major capital projects), which are legally restricted to expenditure for specified purposes. In practice, this definition encompasses legal restrictions imposed by parties outside the government as well as those imposed by the governing body. Examples of these funds include specific tax millages for Streets and Parks, state-shared revenue of Gas and Weight taxes for road maintenance, and Federal and State grants.

Capital Projects Funds – This fund type may be used to account for the proceeds of money set aside for the construction of an asset such as a building. Generally, revenue sources are from the sale of bonds which are legally restricted to expenditures for specified purpose listed in the bond sale.

Debt Service Funds – This fund type is used to account for the payment of the city’s non-Enterprise fund debt. The revenue for this fund comes from a dedicated tax millage specifically for debt retirement.

Enterprise Funds – This fund type may be used to account for operations (a) that are financed and operated in a manner similar to private business enterprises – where the intent of the governing body is that the costs of providing goods or services to the general public on a continuing basis be financed or recovered primarily through user charges; or (b) where the governing body has decided that periodic determination of revenues earned, expenses incurred, and/or net income is appropriate for capital maintenance, public policy, management control accountability, or other purposes. Funds such as Water and Sewer are Enterprise funds.

Internal Service Funds – May be used to account for the financing of goods and services provided by one department to other departments of the governmental unit, or to other governmental units, on a cost-reimbursement basis. It is used if a government intends to recover the full cost of providing a service (including depreciation expense) through interdepartmental charges. Funds such as Information Technology and Fleet Services are Internal Service funds.

Trust and Agency Funds – These funds are used to report assets held in a trustee or agency capacity for others and therefore cannot be used to support the government’s own programs. Funds, such as the Pension Trust fund, is a Trust fund type.

Component Units – Legally separate organizations for which the elected officials of the primary government are financially accountable, such as the Housing Commission or the Downtown Development Authority.