Financial Metrics

Why This Target?

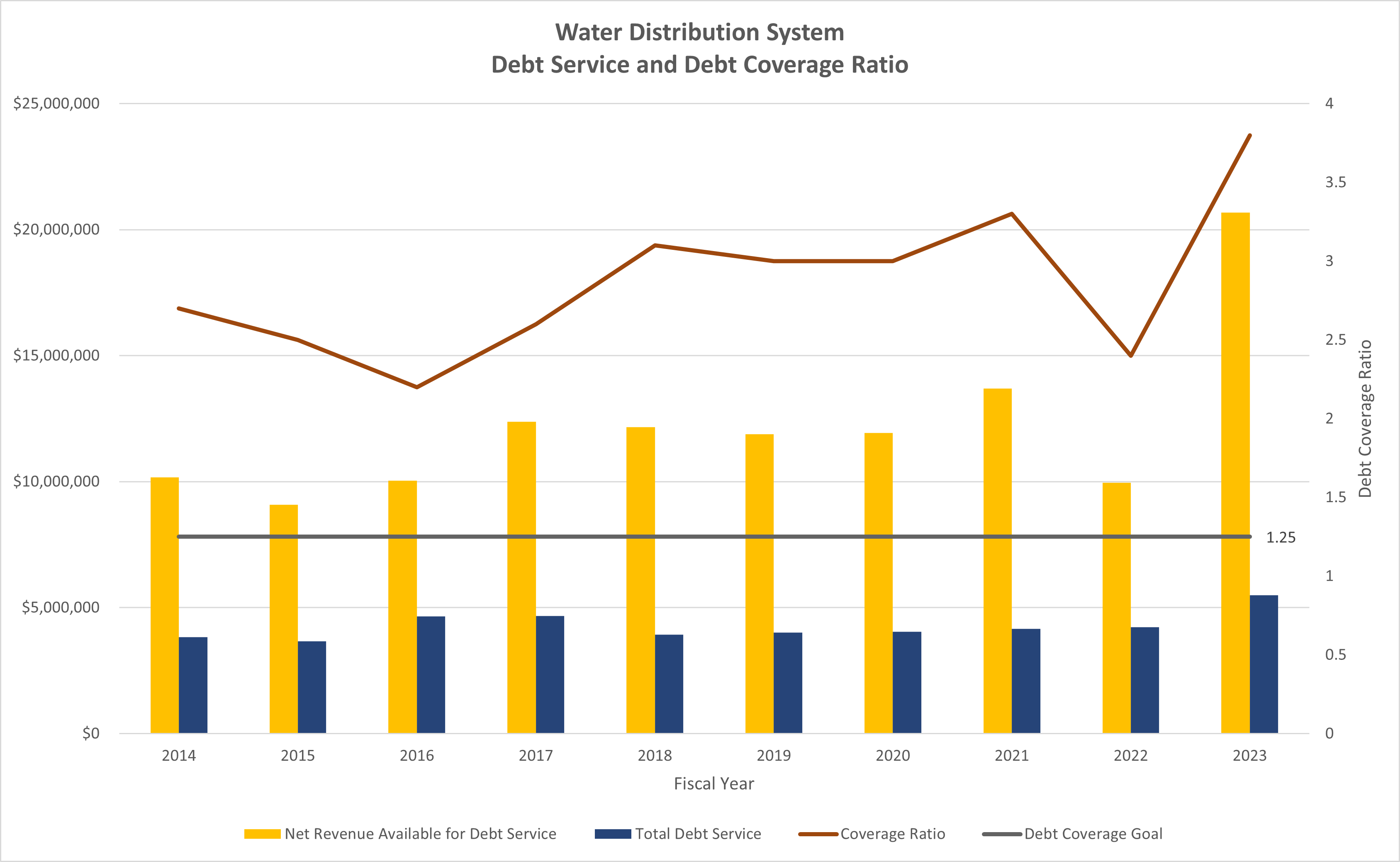

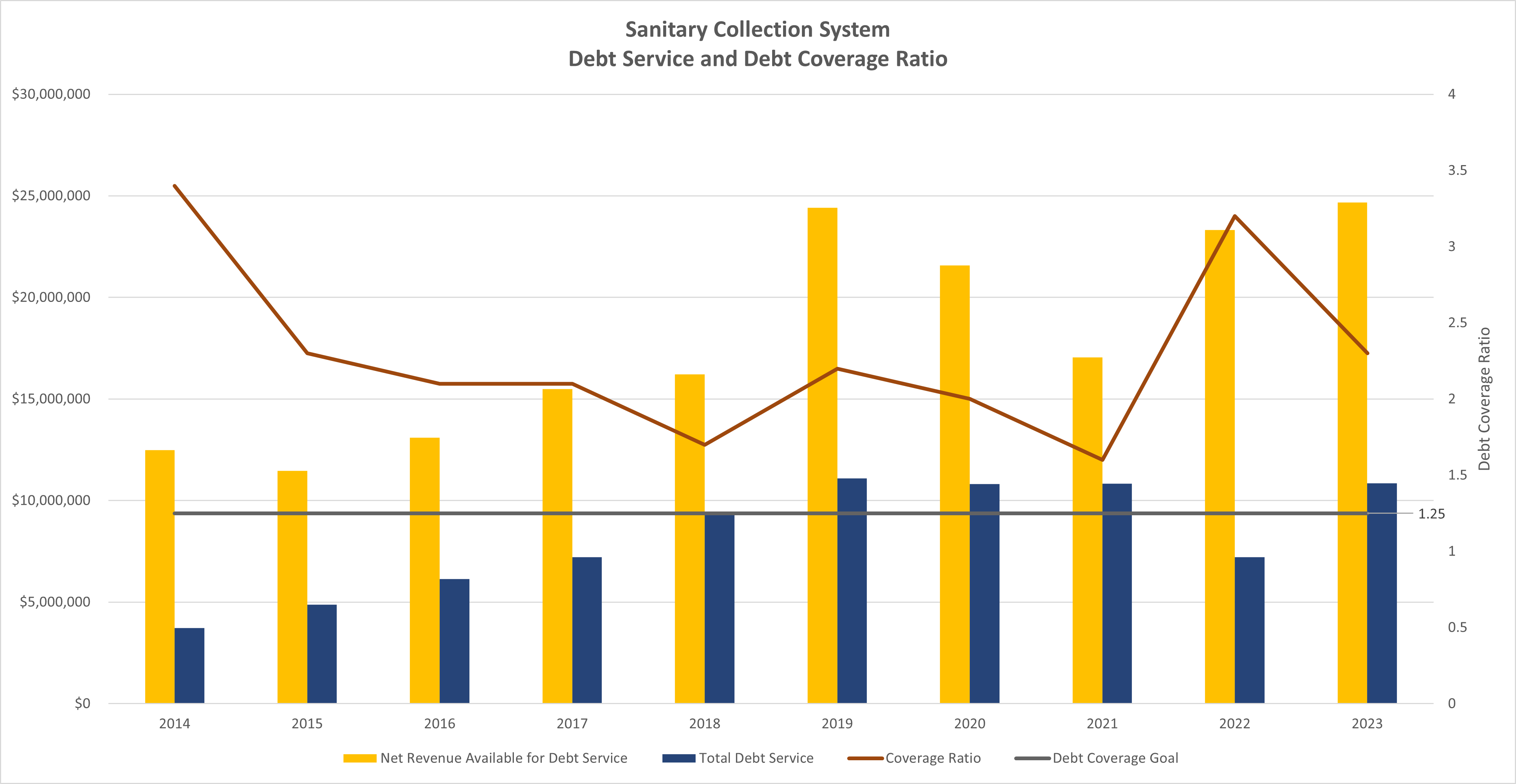

The Debt Coverage Ratio is a metric used to assess an entity's ability to generate enough cash to cover its debt service obligations. It is utilized by crediting agencies when providing ratings and speaks to a fund's overall financial health, ensuring that recurring revenues cover operating expenses and debt payments.

Bond Ratings are another key indicator of financial health. As part of the bond issuance process, a crediting agency evaluates a fund’s financial situation and issues a rating. It is in the City’s best interest to maintain high ratings as they drive interest competitive bids keeping interest rates relatively low.

The Data

Interpreting the results

The City has been able to maintain healthy coverage ratios for its Water and Sanitary Funds.

The City’s most recent bond issuance for the Public Services Area was to borrow $40,000,000.00 in 2023 to fund projects in the City’s Water distribution system. S&P issued a AA rating for that issuance.

The fine print

More of the City's Financial information, including budgets and comprehensive reports can be found here. https://www.a2gov.org/departments/finance-admin-services/financial-reporting/Pages/default.aspx