How are property taxes calculated?

Taxes are calculated by applying the millage rate to every 1,000 dollars of Taxable Value (TV), then adding a 1% administration fee.

Taxable Value / 1,000 x Millage Rate x 1.01

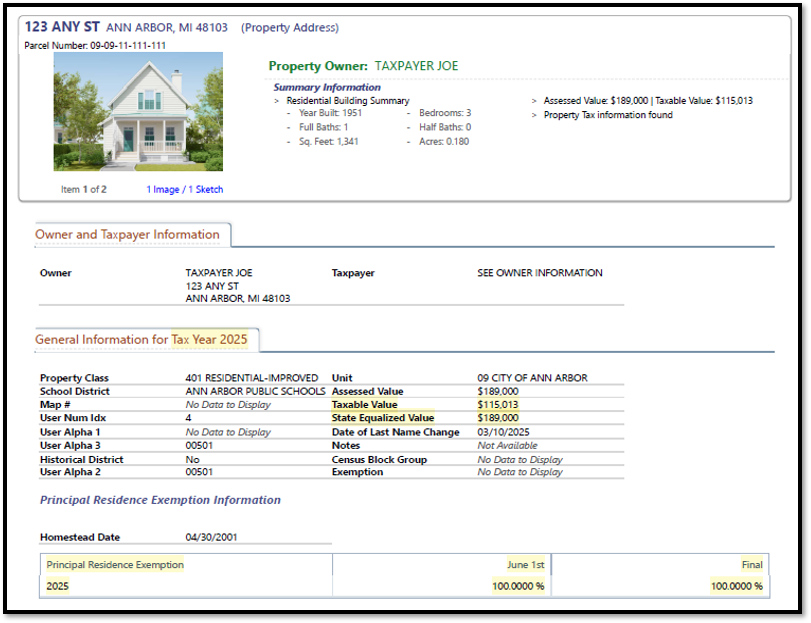

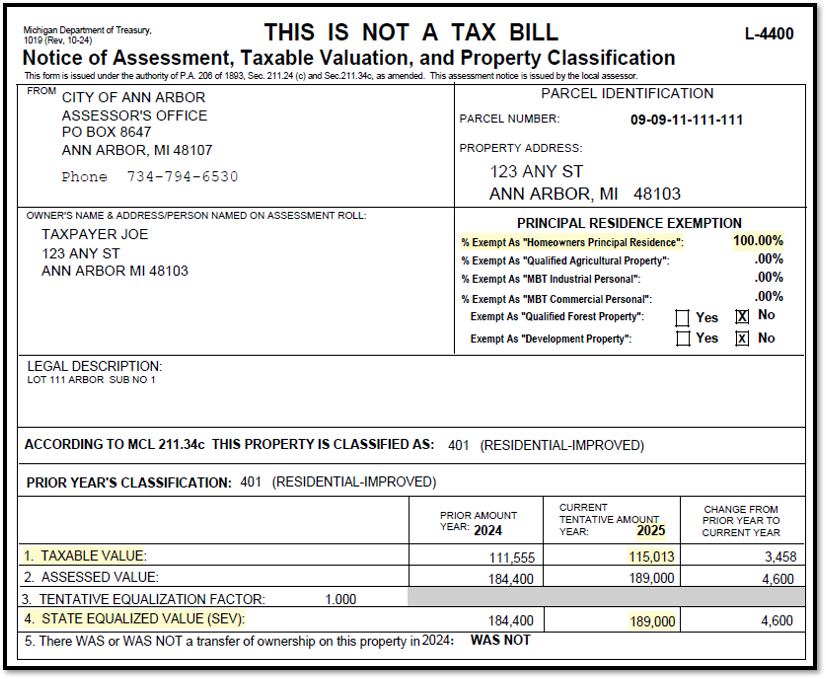

Where do I find the property data?

A Notice of Assessment, Taxable Valuation, and Property Classification is mailed to property owners at the beginning of March each year. The property's Taxable Value and SEV may be found on the Notice of Assessment or on the online property record card here: https://www.bsaonline.com See highlighted documents below to locate the Taxable Value or SEV.

What is the current millage rate?

The most recent available millage rates (subject to change) used in the Property Tax Calculator are found below.

|

Millage Rates - Principal Residence Exemption (PRE): PRE Annual TOTAL: 52.6657 |

Millage Rates - Principal Residence Exemption (Non-PRE): Non-PRE Annual TOTAL: 68.6263 |

Disclaimer - This website and the figures thereon DO NOT represent actual tax liability or formal tax bills for City of Ann Arbor property taxes. The purpose of this website is to generate a rough estimate of potential tax liability based on proposed values, millage rates, and exemptions that are all subject to change. This website should only be used as a resource and no user shall rely on the data generated, given, or extrapolated from this page for tax liability or any other purpose and any user who does so, does it at their own risk. The City of Ann Arbor assumes no liability for the data on or generated by this page and assumes no liability for any user’s usage of, or reliance on it. Use of this worksheet constitutes acceptance of this disclaimer.

Notice of Assessment, Taxable Valuation, and Property Classification

Online property record card